COURSE DESCRIPTION

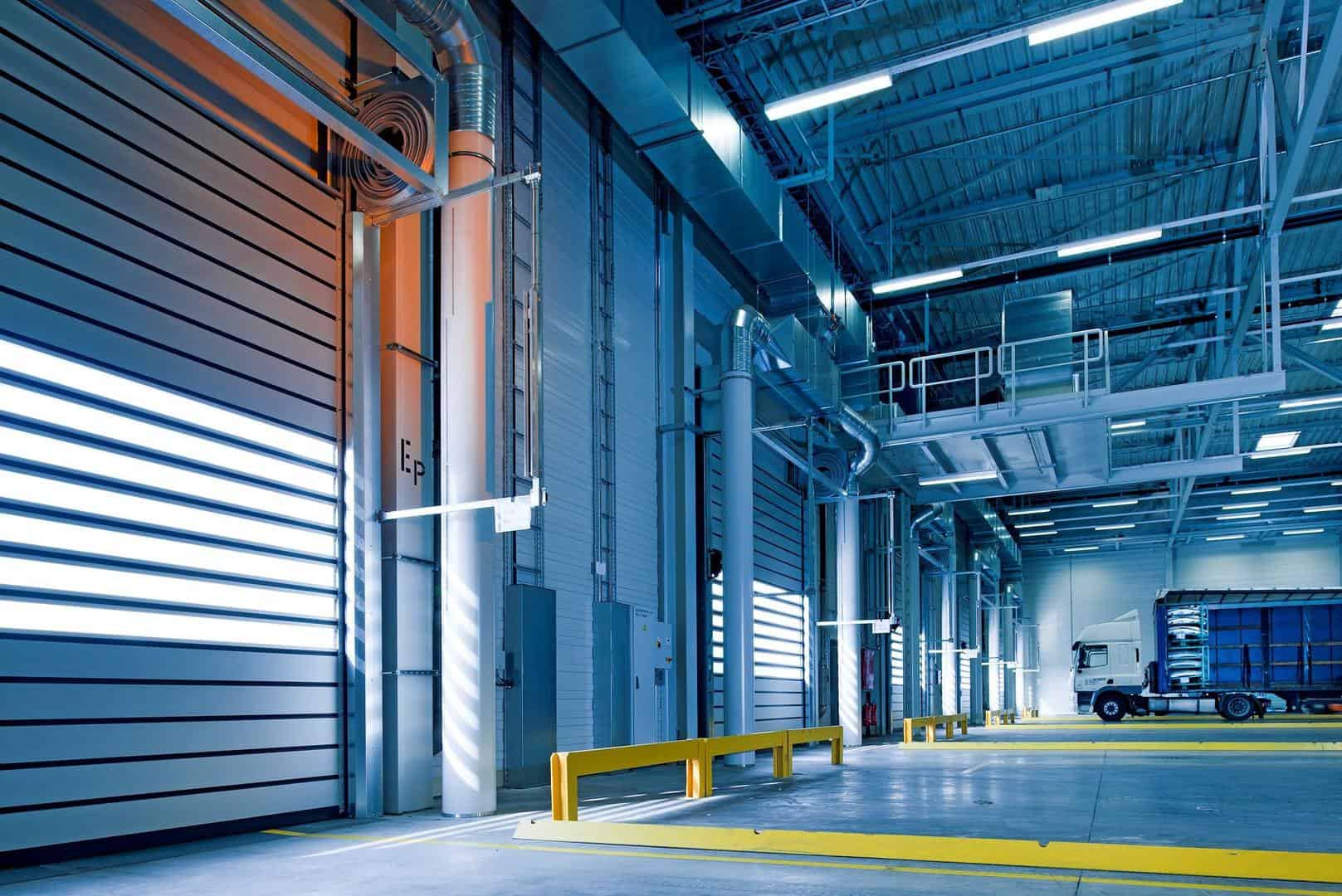

Using a true-to-life Case Study, this mini course teaches the student how to read a typical real estate income statement for industrial properties. This skill is essential for any professional working in, or considering working in, industrial investments – either as an acquisitions, asset management, portfolio management, or development professional.

Knowing how to properly dissect and categorize the income and expense items typical to industrial properties, is an important step to properly modeling industrial cash flows.

CASE DESCRIPTION – PROFESSIONAL INTERVIEW

You have recently been contacted by a friend working at one of A.CRE Advisors competitors, Burton Belasco, LP (BBLP). She is reaching out because there is an exciting job opportunity to become part of their underwriting team. You’ve been at A.CRE Advisors for a few years and it’s crowded at the top, so it’s been tough for your career advancement.

This job opportunity would be a bump in both title and salary. You decide to send her your resume and a few days later, a member of the BBLP team reaches out to you for a first round interview.

In anticipation, you call your friend to ask her for a few tips to prepare. She informs you that in her interview process last year, they wanted to know that she understood fundamental concepts and particularly grilled her on her understanding of line items in the income statements.

She said to make sure you review these items for each asset class and come prepared to answer questions about them. So, before you leave work that day, you manage to scrounge up a few old OMs and property income statements and begin to prepare.

PROPERTY TYPE

- Industrial

SOFTWARE RECOMMENDED/REQUIRED

- While we recommend using Microsoft Excel, as that is the industry standard, this course will work with most other spreadsheet software such as Google Sheets and OpenOffice Calc

EXCEL PROFICIENCY REQUIREMENT

- The course assumes you have at least a basic proficiency working with Microsoft Excel, Google Sheets, or OpenOffice Calc

Course Features

- Lectures 6

- Quiz 1

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 3123

- Certificate No

- Assessments Self

- 1 Section

- 6 Lessons

- Lifetime

- The Industrial Income Statement7

- 1.1Introduction to the Industrial Income Statement

- 1.2Case Study Summary – BBLP Job Interview

- 1.3Summary vs. Detailed Income Statements (Review)

- 1.4Industrial Income and Expense Line Items

- 1.5Calculating Annual Leasing Cost Reserves

- 1.6Case Study – BBLP Job Interview Prep Assignment

- 1.7Industrial Income Statement – Interview Questions (Quiz)60 Minutes10 Questions